Pay Off Your Student Loans Fast With These Tips

-

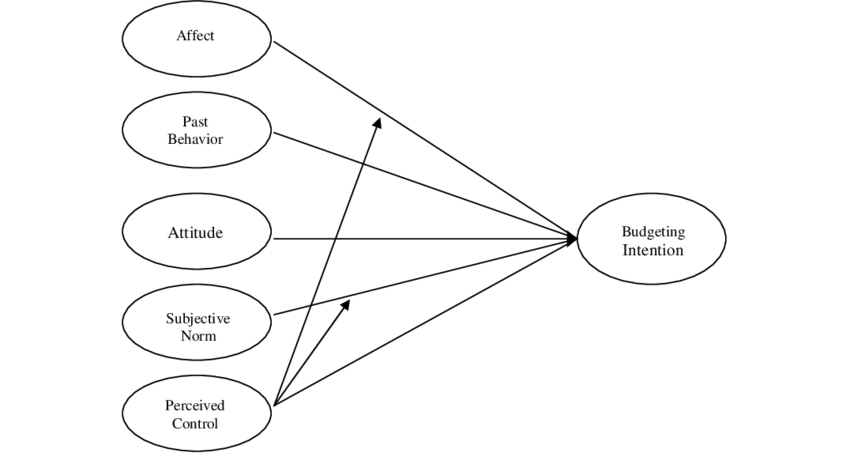

Budget everything with intention

One of the most important principles in planning a life is to have a budget that you follow through with. Many people want to live from this principle but many more people want to use it as an excuse to buy the things they don’t want to buy. You can’t have intentions and desires, if you don’t have the means to pay for them. This is where having a tight budget comes in. When you have a tight budget, you need to know exactly where your money is going and what it’s going to be used for.

Some people think that budgets are only good when you have written everything you want to buy, done with a list, and categorized it by categories like sports equipment, housewares, and personal care products. Well, you can’t really plan everything with intention if you don’t have a way to plan for it. There are some other aspects of a budget that you need to understand if you want to use it to plan everything. If you don’t know how to set up your budget, then you won’t know whether you have everything you want, at the price you can afford. In this article, we’ll be talking about some basic principles of budgets so that you can learn how to set up your own.

Another important principle on how to budget everything is to make sure that you’re not planning for future expenses. If you’re buying something because you need it for future use but later realize that you don’t need it, then you’ll be spending more money in the future. Be patient with your money and don’t let future expenses dictate your decisions.

The last thing that you need to keep in mind when learning about how to budget everything is that you’ll need to set aside a portion of your income for emergency purposes. Some people believe that they’ll be able to budget everything well and be frugal at the same time, but this just isn’t true. If you’re not careful with how much money you spend in a week or month, then you’ll end up worrying about whether you have enough to pay your bills or go on vacation. If you’re going to use money for these things, then you should budget for them ahead of time.

Learning how to make extra payments correctly means that you don’t end up paying more than is necessary. It is very tempting to go ahead and take out a higher credit limit, even if you know you won’t be able to keep up with the payments. It feels good to have that new toy, the one you’ve always wanted, and you think that by paying just a little extra on principle you will be keeping your credit score in good standing. When the debt gets out of control, though, you find that you are paying hundreds or thousands of dollars in unnecessary interest, and your score gets worse.

In order to pay off your student loans on time you will need to thin if ways to track, cut back and save on your expenses. In order to have a good credit score you will need to pay your bills on time to make you more successful with on time payments you might want to make sure you are getting the best price and rates on your services. For example, making an electricity switch to a more affordable provider will make it easier to keep up with your bills.

How to make extra payments correctly starts by understanding that you will not get away with just making the minimum payment. Any company that is going to loan you money will expect you to make regular payments that are made according to their schedule. If you do not, they will either rise your rate or take away the credit. This will damage your credit for as long as you own the credit card, and you may never be able to borrow again.

To learn how to make extra payments on your own, you need to know where to look for the best deals. The first place that you can look for good offers is on the Internet. By doing some simple comparison shopping, you can locate some great introductory offers on credit cards and other personal loans that can save you some serious money. If you do not have a lot of time to shop around, however, you still have a few options to help you learn how to make extra payments on your own.

One of these options is to use a resource called the Debt Consolidation Directory. This database is designed to pair consumers with reputable companies that offer loans and consolidation plans. By using the resources provided by this directory, you can learn how to make extra payments on your own. You should be careful, however, to use the information provided about a particular company with a level of caution. This is because there are many resource directories on the Internet, and if a company is offering a high rate and a bad reputation, you should be wary.

A second option for learning how to make extra payments on your own is to contact your bank or credit union and find out what deals they have available. While many banks will not negotiate payments in excess, some do. If they do offer a payment plan, it might be tied in with a loan you already have with them. On the other hand, credit unions tend to be more flexible with new customers. They might be willing to work out an arrangement that saves you money over the long run.

Many people find that having a good credit rating is vital when trying to get a new job. There are many reasons why it is important to have a good credit rating. The biggest reason of course is because it shows potential employers that you are serious about gaining employment. It is often difficult to gain employment in today’s economy if your credit rating is bad. When a potential employer does a credit check on you, they are likely to either pass you by or hire someone who is more suitable for the position. If you have a poor credit rating, it may be impossible for you to gain employment at all.

However, what if you already have a job? Do you need to focus on having a good credit rating if you are going to apply for another job? Most likely not. Employers are usually not concerned with your credit score when they are making their hiring decisions. However, you should still focus on building a good credit history.

Having a good credit rating will help you when it comes to applying for a secure job. This is because when a prospective employee has a good credit rating, it will be much easier for him or her to gain the employment that they seek. Many people are aware that it is necessary to have a good credit rating in order to secure a job. They should realize though that it is not only possible but also important to have a good credit rating.

One way to ensure that you have a good credit rating is to focus on being responsible with your finances. You should always pay your bills on time. It is also important that you make your payments on time. A credit rating can easily suffer if you become negligent with your finances. Therefore, you should make sure that you keep your credit history in good condition.

Another way to secure a good job is to be aware of what you spend money on each month. A lot of people focus on the credit they have rather than the credit that they spend. They assume that they will not be using that particular credit on the job. The truth is that it is important to have both a credit report that shows that you have paid your bills and also one that shows you have spent money on certain things such as entertainment and other things that are not really relevant to your work.

Besides focusing on having a good credit rating, it is important that you focus on keeping your life in good order. Make sure that all of the bills you pay are in order. Make sure that you have enough money in savings. These two things will help you secure a good job and will allow you to have a good living.