Effective financial management has become more crucial than ever in today’s rapidly evolving economic landscape. Wheon.com finance tips have emerged as a trusted resource for individuals seeking practical, actionable advice to achieve financial stability and build long-term wealth. This comprehensive platform provides expert-backed strategies that span the entire spectrum of personal finance, from fundamental budgeting principles to advanced investment techniques, making financial literacy accessible to everyone, regardless of their current financial knowledge or situation.

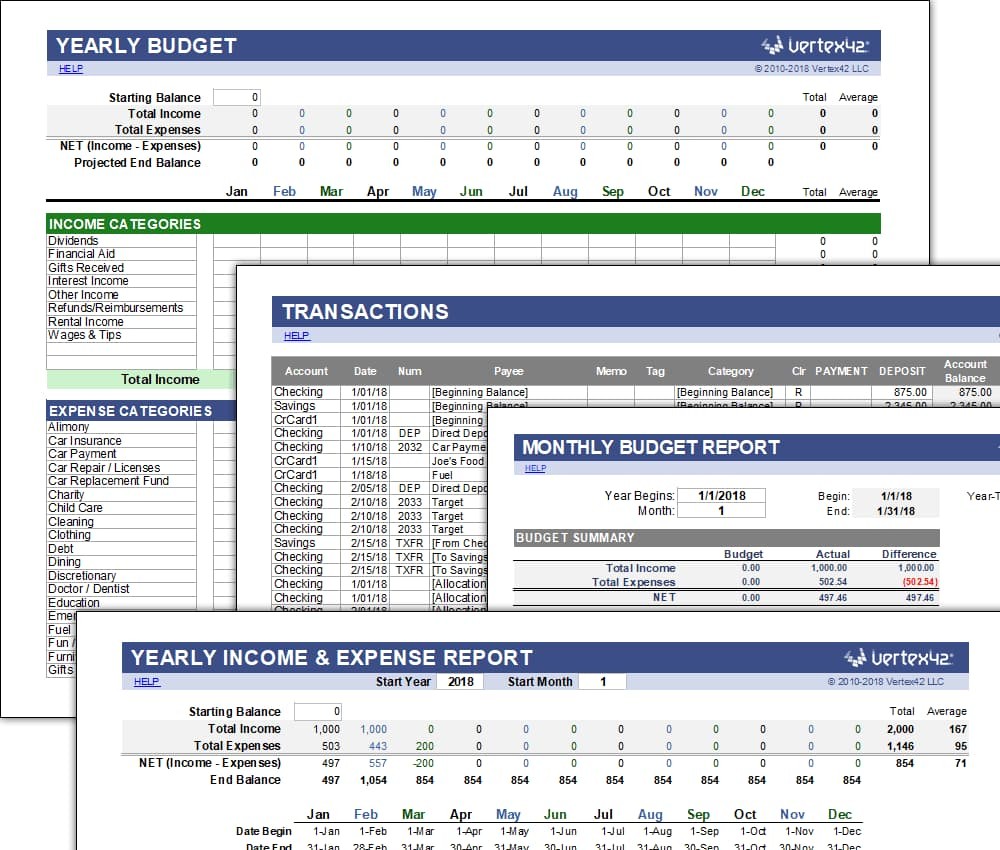

Example Vertex42 financial spreadsheet templates showing yearly budgets, transactions, monthly reports, and income & expense summaries for money management.

The platform’s approach to financial education stands out for its emphasis on simplicity and real-world application, providing users with straightforward guidance that can be implemented immediately. Whether you’re starting your financial journey, recovering from debt, or planning for retirement, Wheon.com finance tips offer the foundational knowledge and strategic insights needed to make informed decisions about your money.

Understanding Wheon.com: A Comprehensive Financial Resource Platform

Wheon.com operates as a multifaceted digital platform that extends far beyond simple financial advice, encompassing various categories including business ideas, health guidance, and comprehensive finance management strategies. The platform has established itself as a go-to destination for practical financial wisdom, particularly excelling in its ability to break down complex financial concepts into digestible, actionable steps that everyday people can understan finance section of Wheon.com covers an extensive range of topics including personal finance fundamentals, investment strategies, business finance principles, financial planning methodologies, and detailed guidance on loans and credit management. What sets this platform apart is its commitment to providing evidence-based advice that comes from established financial principles rather than speculative trends or get-rich-quick schemes.

The platform’s editorial approach focuses on delivering content that serves users across different financial stages and sophistication levels. From college students managing their first budget to experienced professionals planning for retirement, Wheon.com finance tips are designed to provide value regardless of where someone stands in their financial journey.

The Foundation of Financial Success: Budgeting Mastery

Creating and Maintaining an Effective Budget

Budgeting represents the cornerstone of all successful financial strategies, and Wheon.com finance tips emphasize this fundamental principle throughout their guidance. A well-structured budget serves as the foundation upon which all other financial goals are built, providing the framework necessary to track income streams, monitor expenses, and identify opportunities for optimization.

The platform recommends beginning with a comprehensive assessment of your financial situation by documenting all income sources, including primary employment, side hustles, investment returns, and any other revenue streams. This complete picture of incoming funds provides the baseline for all subsequent budgeting decisions and helps ensure that no income source is overlooked in your financial planning process.

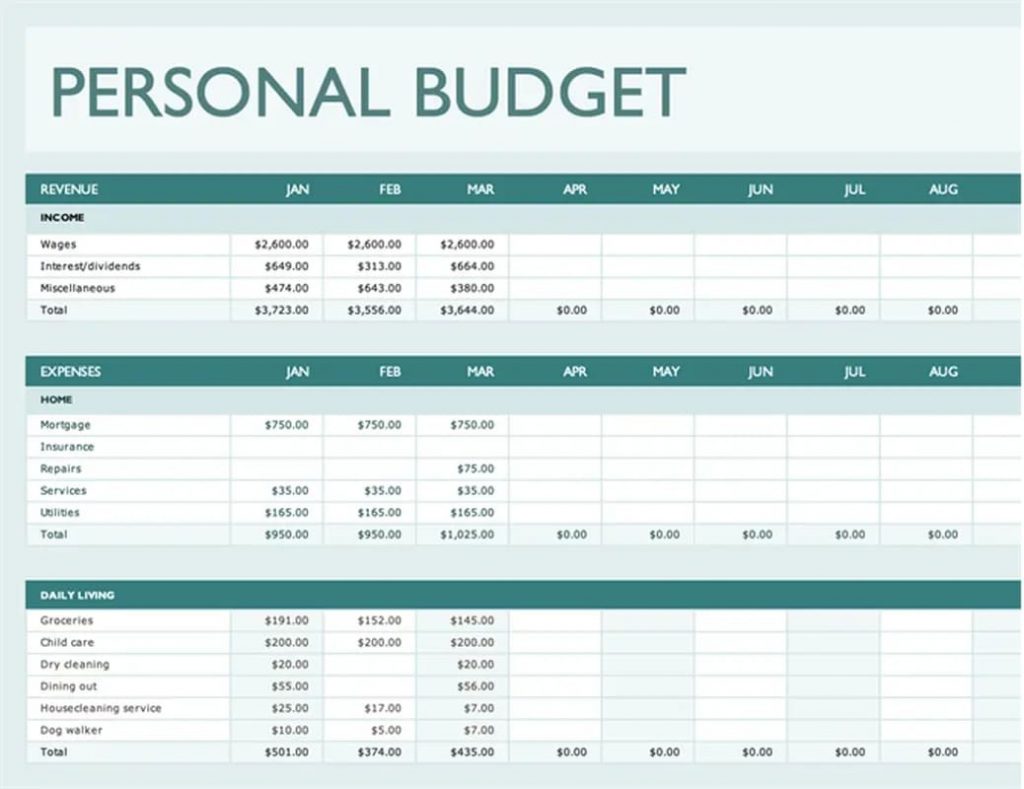

Personal budget spreadsheet template for tracking monthly income and expenses to manage finances.

The 50/30/20 Rule: A Time-Tested Approach

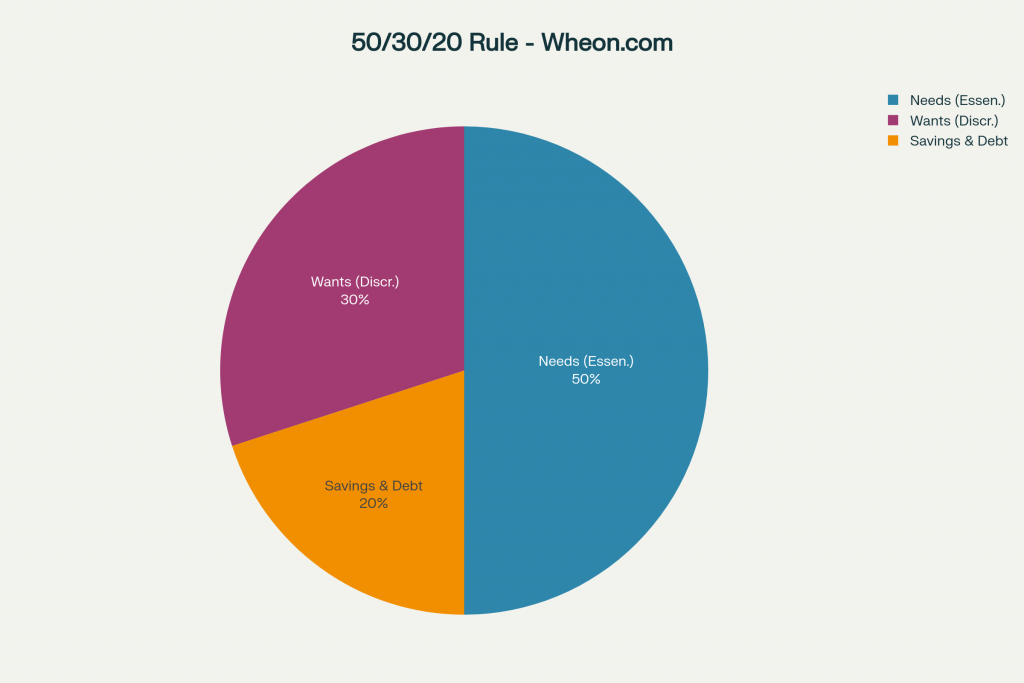

One of the most frequently recommended strategies from Wheon.com finance tips is the 50/30/20 budgeting rule, which provides a simple yet effective framework for allocating income across essential categories. This approach divides after-tax income into three distinct categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

The 50/30/20 Budget Rule – A popular budgeting strategy recommended by Wheon.com finance tips

The “needs” category encompasses all essential expenses that are required for basic living, including housing costs such as rent or mortgage payments, utilities, groceries, transportation expenses, insurance premiums, and minimum debt payments. These represent non-negotiable expenses that must be covered to maintain your current lifestyle and financial obligations.

The “wants” category includes discretionary spending on items and experiences that enhance quality of life but aren’t strictly necessary for survival. This includes dining out, entertainment subscriptions, hobbies, non-essential shopping, and other lifestyle choices that bring enjoyment but could be reduced if necessary.

The final 20% allocation focuses on building financial security through savings and accelerated debt repayment. This portion should be directed toward emergency fund development, retirement account contributions, additional debt payments beyond minimums, and other long-term financial goals.

Advanced Budgeting Strategies and Tools

Wheon.com finance tips also recommend leveraging modern technology to streamline the budgeting process through applications like Mint, YNAB (You Need A Budget), and other comprehensive financial tracking tools. These platforms can automatically categorize expenses, track spending trends, and provide insights into spending patterns that might not be immediately obvious when managing finances manually.

The platform emphasizes the importance of regular budget reviews and adjustments, recommending monthly assessments to ensure that spending aligns with financial goals and life circumstances. These regular check-ins allow for course corrections and help maintain the discipline necessary for long-term financial success.

Building Financial Security Through Strategic Saving

Emergency Fund Development: Your Financial Safety Net

Emergency fund creation represents one of the most critical components of Wheon.com’s finance tips, with the platform consistently emphasizing the importance of maintaining readily accessible cash reserves for unexpected situations. The recommended emergency fund size typically ranges from three to six months of essential living expenses, though individual circumstances may warrant larger reserves depending on job stability, health considerations, and other risk factors.

A locked glass jar containing a sack of money symbolizing secured emergency savings.

The platform advocates for a systematic approach to emergency fund development, beginning with small, achievable goals that build momentum over time. Starting with an initial target of $500 to $1,000 provides immediate peace of mind while working toward the larger goal of complete expense coverage. This incremental approach prevents the overwhelming feeling that can come from trying to save several months of expenses all at once.

Wheon.com finance tips recommend housing emergency funds in high-yield savings accounts that provide easy access while earning competitive interest rates. These accounts should be separate from daily banking to reduce the temptation for unnecessary withdrawals while remaining liquid enough for true emergencies.

Automated Saving Strategies for Consistent Growth

Automation plays a crucial role in the saving strategies recommended by Wheon.com finance tips, with the platform advocating for systematic transfers that remove the decision-making element from regular savings contributions. By setting up automatic transfers from checking to savings accounts immediately after payroll deposits, individuals can ensure consistent progress toward their financial goals without relying on willpower or memory.

The platform suggests treating savings contributions like any other essential bill, prioritizing these transfers before discretionary spending occurs. This “pay yourself first” mentality helps establish savings as a non-negotiable priority rather than something that happens only when money is left over at the end of the month.

High-Yield Savings Optimization

Wheon.com finance tips emphasize the importance of maximizing returns on saved funds through strategic account selection. High-yield savings accounts, often offered by online banks, can provide significantly better interest rates than traditional brick-and-mortar institutions, helping savings grow more rapidly over time.

The platform recommends regularly comparing savings account options and being willing to switch institutions when better rates become available. Even small differences in interest rates can compound to meaningful amounts over time, making this ongoing optimization effort worthwhile for long-term financial growth.

Investment Strategies for Long-Term Wealth Building

Diversification and Portfolio Construction

Investment guidance represents a significant component of Wheon.com finance tips, with the platform emphasizing the critical importance of diversification across asset classes, geographic regions, and investment time horizons. Proper diversification helps reduce portfolio volatility while maintaining growth potential, creating a more stable foundation for long-term wealth accumulation.

The platform recommends beginning with broad-market index funds and exchange-traded funds (ETFs) that provide instant diversification across hundreds or thousands of individual securities. These investment vehicles offer professional management, low fees, and broad market exposure without requiring extensive research or individual stock selection skills.

Wheon.com finance tips also advocate for geographic diversification through international investments, helping reduce dependence on any single country’s economic performance. This global approach can provide additional growth opportunities while reducing overall portfolio risk through exposure to different economic cycles and market conditions.

Dollar-Cost Averaging and Consistent Investment

The platform strongly endorses dollar-cost averaging as an investment strategy that removes the pressure of market timing while building positions gradually over time. This approach involves making regular, fixed-dollar investments regardless of current market conditions, naturally buying more shares when prices are low and fewer shares when prices are high.

This systematic investment approach helps reduce the emotional component of investing while taking advantage of market volatility to build positions at varying price points. Wheon.com finance tips recommend automating these investments just like savings contributions, creating a disciplined approach that continues regardless of market conditions or emotional responses to market movements.

Retirement Account Optimization

Wheon.com finance tips place significant emphasis on maximizing tax-advantaged retirement account contributions, including 401(k) plans, traditional and Roth IRAs, and other employer-sponsored retirement benefits. These accounts provide powerful tax benefits that can significantly enhance long-term wealth accumulation when used strategically.

An elderly couple using a laptop in a modern kitchen, symbolizing retirement planning and financial future discussions.

The platform recommends prioritizing employer 401(k) matching contributions as the highest-priority investment, since these represent immediate 100% returns on contributed funds. After maximizing employer matches, the guidance suggests filling additional tax-advantaged space through IRA contributions and increased 401(k) contributions beyond the matching threshold.

Real Estate and Alternative Investments

While emphasizing the importance of traditional stock and bond investments, Wheon.com finance tips also explore alternative investment options, including real estate investment trusts (REITs), peer-to-peer lending, and other diversifying assets. These alternatives can provide different risk and return characteristics while reducing correlation with traditional stock market movements.

The platform approaches real estate investment from multiple angles, discussing both direct property ownership for rental income and REIT investments for those seeking real estate exposure without direct property management responsibilities. Each approach offers distinct advantages and challenges that should be carefully considered based on individual circumstances and preferences.

Debt Management and Credit Optimization

Strategic Debt Repayment Methodologies

Wheon.com finance tips provide comprehensive guidance on debt management strategies, recognizing that effective debt elimination is crucial for long-term financial success. The platform outlines multiple approaches to debt repayment, allowing individuals to choose strategies that align with their psychological preferences and financial situations.

Eight practical steps to get out of debt, including understanding debt, planning repayment, and consulting financial advisors.

The debt snowball method focuses on paying minimum amounts on all debts while directing extra payments toward the smallest debt balance. This approach provides psychological momentum through quick wins as smaller debts are eliminated, creating motivation to continue the debt elimination process. Once the smallest debt is paid off, its former payment amount is added to the next smallest debt payment, creating a snowball effect.

Alternatively, the debt avalanche method prioritizes debts with the highest interest rates regardless of balance size. This mathematically optimal approach minimizes total interest paid over time, though it may take longer to see the psychological benefits of eliminating debts. Wheon.com finance tips recommend choosing the method that best fits individual motivation patterns and financial discipline levels.

Credit Score Improvement Strategies

Credit score optimization represents another critical component of the platform’s financial guidance, with Wheon.com finance tips outlining specific strategies for improving creditworthiness over time. Payment history, representing 35% of most credit scoring models, serves as the foundation for all credit improvement efforts, making on-time payments the single most important factor in maintaining and improving credit scores.

The platform emphasizes the importance of credit utilization management, recommending keeping credit card balances below 30% of available limits, with utilization below 10% being ideal for score optimization. This strategy requires either paying down existing balances or requesting credit limit increases to improve utilization ratios without changing spending patterns.

Wheon.com finance tips also address the importance of credit report monitoring and error correction, recommending regular reviews of all three major credit bureau reports to identify and dispute any inaccuracies. These errors can significantly impact credit scores, and their correction can provide immediate score improvements when successfully resolved.

Debt Consolidation and Refinancing Options

The platform explores various debt consolidation strategies that can simplify payments while potentially reducing interest costs. Personal loans for debt consolidation can replace multiple high-interest credit card balances with a single, fixed-rate payment, often at lower interest rates than the original debt.

Balance transfer credit cards represent another consolidation option highlighted in Wheon.com finance tips, particularly those offering promotional 0% interest periods. These products can provide temporary payment relief while allowing aggressive principal reduction, though they require discipline to avoid accumulating new debt on cleared cards.

Retirement Planning and Long-Term Financial Security

Retirement Savings Fundamentals

Wheon.com finance tips emphasize that retirement planning should begin as early as possible to take full advantage of compound growth over time. The platform stresses that even small contributions made early in one’s career can grow to substantial amounts by retirement age, making the starting point more important than contribution size for young savers.

Elderly couple reviewing financial documents and retirement planning together at home.

The platform recommends aiming to replace 70-90% of pre-retirement income through a combination of Social Security benefits, employer-sponsored retirement plans, and personal savings. Since Social Security typically replaces only about 40% of pre-retirement income, personal savings must make up the substantial difference to maintain lifestyle standards in retirement.

Wheon.com finance tips advocate for gradually increasing retirement contributions over time, particularly when receiving salary increases or bonuses. This approach allows for lifestyle maintenance while steadily building retirement security, making larger contribution increases less noticeable in current budgets.

Tax-Advantaged Account Strategies

The platform provides detailed guidance on optimizing various retirement account types, including traditional 401(k)s, Roth 401(k)s, traditional IRAs, and Roth IRAs. Each account type offers different tax advantages and withdrawal rules, requiring strategic planning to maximize its benefits over time.

Wheon.com finance tips generally recommend traditional accounts for individuals currently in higher tax brackets who expect to be in lower brackets during retirement. Conversely, Roth accounts benefit those currently in lower tax brackets or those who expect higher tax rates in retirement, since contributions are made with after-tax dollars but withdrawals are tax-free.

The platform also addresses required minimum distribution (RMD) planning, helping individuals understand how these mandatory withdrawals from traditional retirement accounts can impact tax planning and estate planning strategies.

Smart Spending and Frugal Living Strategies

Mindful Consumption and Value-Based Spending

Wheon.com finance tips promote mindful spending practices that align purchases with personal values and long-term goals rather than impulse decisions or social pressures. The platform emphasizes the distinction between needs and wants, encouraging readers to pause before major purchases to evaluate their true necessity and value.

The guidance includes practical strategies for reducing everyday expenses without significantly impacting quality of life. These include bulk purchasing for non-perishable items, using cashback applications and browser extensions for online purchases, and taking advantage of loyalty programs and discount opportunities.

Wheon.com finance tips also address the psychological aspects of spending, recognizing that emotional triggers often drive unnecessary purchases. The platform recommends implementing waiting periods for significant discretionary purchases, allowing time for rational evaluation of the purchase necessity and alignment with financial goals.

Subscription and Recurring Payment Optimization

The platform highlights the importance of regularly auditing recurring payments and subscription services, as these automated charges can accumulate significantly over time without providing proportional value. Wheon.com finance tips recommend conducting quarterly reviews of all automatic payments to identify unused or underutilized services that can be canceled.

This optimization extends to insurance policies, utility providers, and other recurring services where regular comparison shopping can yield substantial savings. The platform encourages treating these recurring expenses as ongoing decisions rather than permanent commitments, regularly evaluating whether current providers offer the best value for money.

Advanced Financial Strategies and Passive Income Development

Building Multiple Income Streams

Wheon.com finance tips recognize that income diversification provides both financial security and wealth-building acceleration. The platform explores various passive income strategies, including dividend-paying stocks, real estate investment trusts, peer-to-peer lending, and business ownership, that can generate ongoing revenue with minimal active involvement.

The guidance emphasizes starting with modest passive income goals that can be achieved through existing skills and resources. This might include freelance writing, online course creation, or affiliate marketing that leverages existing knowledge and networks to generate additional revenue streams.

Wheon.com finance tips also address the importance of reinvesting passive income to compound growth over time. Rather than immediately spending additional income, the platform recommends directing these funds toward further income-generating investments or debt reduction to accelerate overall financial progress.

Cryptocurrency and Alternative Investment Considerations

While maintaining a conservative overall approach, Wheon.com finance tips acknowledge the role that cryptocurrency and other alternative investments might play in diversified portfolios. The platform emphasizes the high-risk nature of these investments while providing guidance for those who choose to include them in their financial strategies.

The guidance stresses the importance of limiting cryptocurrency exposure to amounts individuals can afford to lose entirely, typically recommending no more than 5% of total investment portfolios for these speculative assets. The platform also emphasizes the importance of understanding the technology and market dynamics before investing in cryptocurrency or other alternative assets.

Technology Integration and Financial Apps

Leveraging Financial Technology Tools

Wheon.com finance tips encourage the strategic use of financial technology to automate and optimize money management processes. The platform reviews various budgeting applications, investment platforms, and financial tracking tools that can simplify complex financial tasks while providing valuable insights into spending and saving patterns.

The guidance includes recommendations for specific applications based on different user needs and preferences, from simple budgeting tools for beginners to sophisticated investment platforms for experienced investors. The platform emphasizes the importance of choosing tools that integrate well with existing financial institutions and provide the level of detail and control needed for individual financial situations.

Wheon.com finance tips also address security considerations when using financial technology, recommending strong password practices, two-factor authentication, and regular account monitoring to protect sensitive financial information. The platform balances the convenience benefits of financial technology with the security precautions necessary to protect personal financial data.

Automation and Optimization Systems

The platform strongly advocates for automating as many financial processes as possible to reduce the reliance on willpower and memory for financial success. This includes automated savings transfers, investment contributions, bill payments, and debt payments that occur without requiring active decision-making.

Wheon.com finance tips recommend setting up these automated systems during periods of high motivation and financial clarity, ensuring they continue working even during busy or stressful periods when financial attention might be diverted. This systematic approach helps maintain financial progress regardless of life circumstances or emotional states.

Conclusion: Building a Sustainable Financial Future

Wheon.com finance tips provide a comprehensive framework for achieving financial success through practical, evidence-based strategies that can be implemented by individuals at any stage of their financial journey. The platform’s emphasis on fundamental principles like budgeting, saving, investing, and debt management creates a solid foundation for long-term wealth building and financial security.

The key to success with these strategies lies in consistent implementation over time rather than perfect execution from the beginning. Wheon.com finance tips recognize that financial improvement is a gradual process that requires patience, discipline, and regular adjustments as life circumstances change and financial knowledge grows.

By following the comprehensive guidance provided through Wheon.com finance tips, individuals can develop the knowledge, skills, and habits necessary to achieve their financial goals while building lasting security for themselves and their families. The platform’s practical approach ensures that these strategies remain accessible and implementable regardless of current financial circumstances or previous financial experience.

The journey toward financial independence and security begins with a single step, and Wheon.com finance tips provide the roadmap needed to navigate this journey successfully. Through careful planning, consistent execution, and ongoing learning, anyone can build the financial future they envision using these time-tested principles and strategies.