The Constant Emergence of Fintech in Global Travel: What You Have to Realize

In the past years, Fintech has disrupted many industries, and it looks like the Travel sector won’t be any different. In a more networked planet, the way one globetrots is getting extremely more complex and exacting, hence the innovative solutions needed to avail more convenience, efficiency, and security. Global travel and how one treks around the world is growingly being impacted by Fintech—particularly with the growing role of eSIMs in travel, the use of advanced payment systems, and several other travel fintech solutions. We’ll also highlight how firms like Zetexa are at the forefront of delivering innovative global travel services.

The Evolution of Travel Fintech

Fintech in travel is a lot more than only a technological phenomenon—it transforms the very way we manage and experience travel. Traditional ways of traveling were a sequence of individual, many times cumbersome, activities—booking a flight, money management, staying in touch while abroad. The rise of travel fintech then came into play, consolidating all these with comprehensive solutions that indeed enhance the overall journey.

Arguably one of the most impactful innovations in travel fintech is the development of global travel eSIMs. Traditional SIM cards need to be physically exchanged when moving environments or, in other words, from one country to another; this is often not very convenient and sometimes quite expensive. In contrast, global eSIMs are digital SIM cards that allow travelers simply to turn on a local network without switching physical SIMs. This brings a number of advantages:

Enhanced Convenience: The availability of this global travel eSIM avails consumers the convenience of downloading and activating their SIM card through a QR code or mobile app, which eventually negates the requirement for visiting physical stores or waiting for SIM cards through mail and hence easily connected from the second of arrival at the respective destinations.

Cost-Effective: Global travel eSIMs generally come with good prices and nice data plans. This way, the traveler can pick and choose the packages as per their requirements without getting anxious about high roaming charges or some unexpected fees. This is more preferable and cost-effective for travelers traveling on a regular basis or for an extended period.

Easy, intuitive swim: A world eSIM offers the ability for customers to switch from a variety of different networks across different countries without the necessity of changing SIM cards on a physical basis. This assures a most reliable and constant connection, important to contact family and access maps or travel apps.

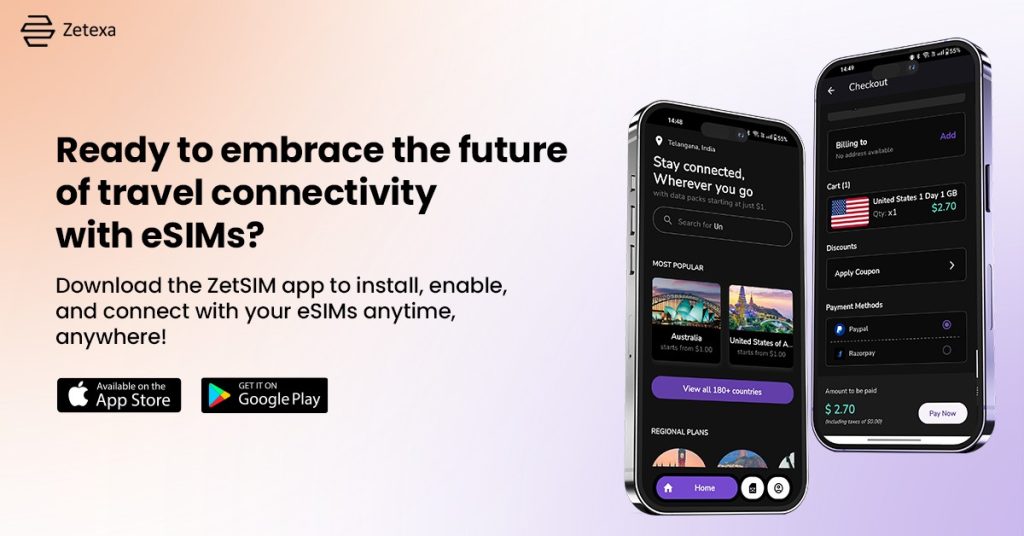

Zetexa is one of the most prominent fintech travel space players, offering a variety of global travel eSIM designed to give power in connectivity and smoothen the travel experience. Their solutions provide the customers with extensive coverage, easy activation, and very competitive rates, subsequently becoming a go-to for travelers aiming for hassle-free connectivity.

Next-Generation Payment Systems

Another important aspect in which travel fintech will bring transformation is in payment systems. Times of unnecessary inconvenience and high cost in handling transactions while traveling abroad to exchange currency or handle foreign transaction rates are gone.

The following are some of the ways fintech offers innovative solutions:

Digital wallets, such as Apple Pay, Google Wallet, and Samsung Pay, have transformed the way travelers make payments in their respective domains. Such wallets allow users to store their credit and debit information digitally, thus enabling safe though contactless transactions. It also reduces the need of cash or cards, enhancing convenience and security.

Virtual Currencies: As virtual currencies become more popular, such as Bitcoin and Ethereum, some tour operators begin to accept virtual currencies as a payment. It eliminates their reliance on any specific traditional currency and benefits a growing group of computer-savvy travelers who use them for transactions.

Real-time Currency Exchange: One of the benefits of fintech offerings with respect to currency exchange includes mobile applications or platforms that empower its customers to offer real-time exchange rates, lower fees, and smooth transactions, which will empower travellers to walk away from not-so-good exchange rates and allow them to budget, save, and spend their money better abroad.

Integrated Financial Services: Most modern fintech platforms bundle integrated financial services, budgeting tools, expense tracking, and currency conversion. This helps the traveler to finance rigorously, allowing them to be within their respective budget limit and make them steer clear of unplanned expenses.

The Impact of Fintech on Traveler Experience

Fintech is very well known to transform the travel services provided to the traveler. Through the structuring of connectivity, ease in payment, and offering financial management, travel fintech further promotes convenience, reduces stress, and allows better control over travel arrangements.

Personalization and AI

Personalization is in fact one of the biggest trends defining the shape of travel fintech in the near future.AI-driven platforms are able to analyze traveler preferences, behavior, and past experiences to be able to provide individual recommendations and services. This can refer to personalized travel itineraries, customized offers, and targeted promotions.

For instance, AI algorithms can suggest potential activities, accommodation, and food choices to a traveler that can be liked or preferred based on interest or past selections. This would take the personal touch to new fortitudes, personalizing the travel experience and making it more relevant and enjoyable.

Integration with the Internet of Things (IoT)

One more important technological trend that the travel fintech is dealing with is the Internet of Things. The Internet of Things is a very advanced technology that interconnects and makes communication between devices and systems frictionless. Examples include smart luggage, travel apps, and real-time tracking systems within the travel industry.

Smart suitcases equipped with GPS will assist travelers in finding their bags if they somehow cannot be found. Travel apps that are connected will update the traveler on whether the flight has a status change, the type of weather expected, and what attractions are nearby. Travelers are thus put much more in control with these Internet of Things-enabled appliances, making travel much easier. Security is also increased.

Issues of security become paramount when digital transactions and connectivity increase. Robust security measures should concern travel fintech solutions related to safeguarding personal and financial information of travelers. This embodies an encryption process, multi-factor verification, and fraud detection systems to bar unauthorized access to data.

Moreover, built-in security capabilities include advanced ones that enable data protection and security in transactions in digital wallets and global travel eSIMs. Fintech solutions that take care of security boost a great deal of trust and confidence out of travelers.

The Role Played by Zetexa in Shaping the Future

Zetexa Global Travel eSIM: Zetexa is yet another world-first smart chip driving global travel eSIM connectivity and is one of the pivotal initiatives to rev up and change the contours of how users consume travel fintech. Our innovative solutions are built around the ever-changing requirements of the modern-day tourist: reliability, competitive pricing, and ease of use.

Zetexa has developed into one of the leaders in global travel eSIM technology that provides seamless connectivity to have an extraordinary travel experience across multiple countries. And its eSIM solutions do provide the easy activation of expansive coverage with flexible data plans, enabling travel aficionados to easily and effectively stay in touch with others while exploring new destinations.

Besides global travel eSIMs, Zetexa is exploring new age fintech solutions that would complement the emerging trends and technologies.

This again reaffirms that the company’s commitment toward innovation and giving customers the best possible services is what has made Zetexa top in the global travel service sector.

Focus on Customer Experience

As for the company, Zetexa highly professes the aspect of an incredible customer experience. The view is in tandem with its user-friendly platforms, responsive customer service, and the clear pricing policies put in place; there is a show of dedication to the meeting of traveler needs. With the customer satisfaction channels in place, Zetexa ensures the travelers find an amazing and easy time using the service.

How global travel fintech is redefining the business:

How it offers innovative solutions, how better connectivity is achieved, how payments are made more seamlessly, and how it enhances general travel. Global eSIM and real-time currency exchange are examples of digital transformation.

With the advancement of technology, the fintech world of travel is going to have a bright future. Zetexa is a company and service on the front line in the global service industry, helping modern travelers operate with connected and frictionless financial services.

Whether you travel on a new adventure or manage the routines of travel, fintech will have made it easier to manage in a global landscape. This travel, modernized because of technology, allows today’s travelers to move in ease and full pleasure, albeit ensuring easiness and control in their voyage. In short, the amalgamation of fintech with the global world of travel will pave the way for a more connected, efficient, and personalized travel experience—which ensures that there has never been a more efficient way of seeing the world with confidence.