The Steps Healthcare Providers Must Take to Get Ready for an Audit

Healthcare providers of all sizes face the possibility of audits to ensure compliance and proper billing practices. Revenue cycle audits examine the processes for billing and collecting payments to identify any issues or errors leading to lost revenue. Providers should take proactive steps to get ready for audits and minimize problems.

Perform Internal Audits

The best defense is a strong offense when preparing for a revenue cycle audit. Providers should perform regular internal audits to identify any weaknesses in revenue cycle management. This involves examining current processes and systems to catch errors and improve areas of concern. Internal audits should review billing accuracy, denied claims, coding quality, outdated contracts, staff training, and more. Any deficiencies found can be corrected before an external audit occurs. Doing routine self-audits demonstrates the provider is committed to compliance. Auditors appreciate seeing a record of internal audits.

Organize Documentation

Auditors will request to see documentation that supports charges, billing codes, payments, and other revenue cycle activities. Disorganized paperwork leads to problems and frustration during audits. Providers should implement document management systems that:

- Store records like claims and patient charts digitally for easy access

- Have well-organized physical files for other documentation

- Allow staff to quickly gather requested audit materials

Maintaining proper documentation helps audits run more smoothly and avoids questioning of the provider’s billing integrity. Well-organized records impress auditors.

Train Staff

Employees who handle billing and revenue cycle processes should understand compliance regulations. They need to know how to accurately assign diagnosis codes, document charges, submit claims, and handle payments.

Provide regular training to keep staff knowledge current on issues like:

- Proper coding with ICD-10

- Billing rules for Medicare, Medicaid, and private insurers

- Documentation required in patient records

- Steps for working on denied claims and appeals

Educated staff will help minimize mistakes that lead to problems in audits. Training also boosts morale in dealing with auditors professionally. Ongoing education is key.

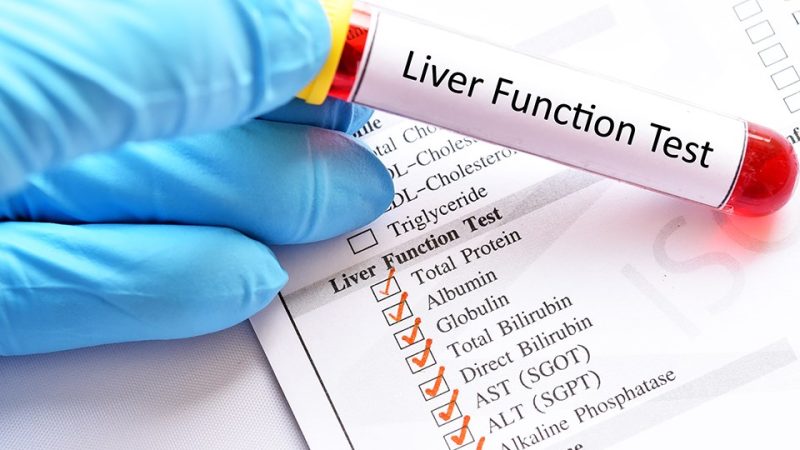

Review Coding Practices

Medical coding translates patient services into the standard codes submitted on insurance claims. Coding quality greatly affects revenue and compliance. Providers should periodically review a sample of patient records and claims to check for:

- Missing codes for administered services

- Unbundling errors that break out code combinations

- Incorrect codes that don’t match the treatment given

- Outdated codes no longer in use

Identifying coding issues lets providers correct problems prior to audits. It also indicates where added coder training may help. Consistent reviews ensure quality.

Confirm Contracts are Current

Many providers operate under contracts with health insurance plans. Confirm that current copies of all active contracts are on file. If any are outdated, immediately contact payers to get updated ones.

Using expired contracts can lead to underpayments and problems in audits. Staying updated ensures payment rates match current agreements. Having valid contracts avoids disputes.

Preparation is Key

While nerve-racking, audits are unavoidable in healthcare. Following these best practices helps providers proactively prepare for audits. Addressing problems early and organizing systems limits challenges during the audit process. With upfront work, providers can demonstrate compliance and effective revenue cycle management. Thorough preparation is the best approach.